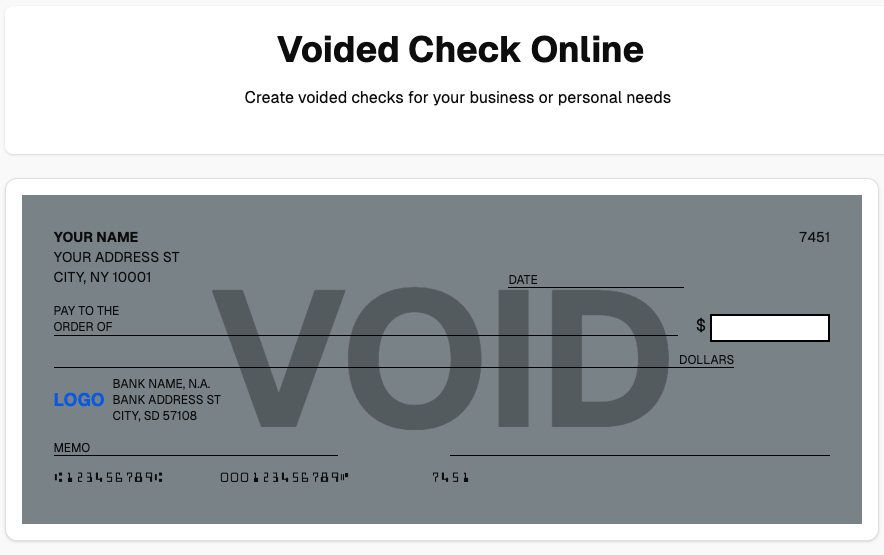

The #1 Online Voided Check Maker

Create voided checks online,

without a physical check order

Create voided checks for your business or personal needs.

No more waiting for checks to arrive in the mail!

See how it works · Browse supported banks · FAQ

YOUR ADDRESS ST

CITY, NY 10001

Bank Address St

City, State 10001

Account Details

Bank Address:

Bank Name

Bank Address St

City, State 10001

** My Check Pros is not affiliated with, endorsed by, or in any way officially connected with any financial institutions mentioned. Read our disclaimer.

As seen on:

All checks include

- ✓ PDF and JPG check format per person

- ✓ Unique bank templates per check

- ✓ High quality printable size

How it works

- ✓ Choose your bank

- ✓ Enter your account details and preview

- ✓ Download instantly as PDF or JPG

Why create a voided check?

- ✓ Prove ownership of a bank account

- ✓ Set up automatic payments for bills

- ✓ Set up direct deposit for payroll

1,228,221 online voided checks already generated for 8,469 happy customers!

See how real users are utilizing our voided check maker app for their unique needs.

5

Star User Rating

⭐ ⭐ ⭐ ⭐ ⭐

10K+

Active Users

In Last 5 Years

1M+

Void Checks Created

Since We Started

Perfect for Payroll Setup

As a small business owner, setting up direct deposit for 20+ employees was daunting. This service made it incredibly simple - generated all the voided checks in minutes. Saved hours of bank visits!

Reliable for Personal Banking

Needed a voided check for automatic bill payments but was out of checks. This service was exactly what I needed - fast, accurate, and accepted by my service provider without any issues.

Essential Business Tool

Our accounting department uses this regularly for setting up vendor payments. The professional quality and security features give us confidence. Highly recommend for business use.

Quick Direct Deposit Setup

As someone who banks entirely online, getting a voided check was always a hassle. This tool made it super easy and the check was accepted right away for my direct deposit.

Great for Property Management

Managing multiple rental properties, I needed voided checks for various payment setups. This service streamlined our entire process. Now we can set up new payment systems in minutes.

Perfect for Freelancers

As a freelancer with multiple clients, I frequently need voided checks for payment setup. This service has become an essential part of my business toolkit. Simple and professional!

Startup Friendly Solution

Our startup needed to set up payments for various services quickly. This tool saved us countless hours of back-and-forth with our bank. The checks are always accepted without question.

Non-Profit Game Changer

Managing a non-profit, we needed a cost-effective way to set up recurring donations. This service made it possible to quickly generate voided checks for all our automatic payment setups.

What is a Voided Check?

A voided check is a standard personal or business check that has the word "VOID" written across the front in large letters. This indicates that the check cannot be used for cash withdrawal or payment, yet it serves a crucial purpose: strictly for providing verified banking information.

Employers, lenders, and service providers require a voided check to ensure they have the correct:

- Routing Number: The 9-digit ID of your financial institution.

- Account Number: Your unique checking account identifier.

- Account Holder Details: Your legal name and address on file.

Don't have a checkbook? Our secure voided check generator creates a compliant, professional PDF image instantly perfect for when you need to provide bank details without ordering a box of physical checks.

Direct Deposit Authorization

The most common use for a voided check is setting up direct deposit with your employer's HR department or payroll provider (like ADP, Paychex, or Gusto).

By attaching a voided check to your direct deposit form, you eliminate transcription errors, ensuring your paycheck arrives in your account on time, every time. It is also essential for receiving government benefits or tax refunds via ACH transfer.

Automatic Bill Payments

Simplify your finances by setting up autopay for recurring expenses. Gym memberships, utility bills, car loans, and mortgages often require a voided check to authorize ACH withdrawals, ensuring you never miss a due date.

Business & Bank Verification

Freelancers and businesses use voided checks to set up vendor payments or authorize merchant accounts. It also serves as proof of account ownership for loan applications or when linking external bank accounts.

How to Void a Check Manually (Step-by-Step)

If you already have a checkbook handy, you can create a voided check yourself in just a few steps. This is the traditional method used before online tools became available.

- Use a blue or black pen: Use a pen with dark ink to ensure the check copies clearly when photocopied or faxed.

- Write "VOID" in large letters: Write the word "VOID" across the front of the check in large, widely spaced letters. You can also write it in smaller letters on the signature line, date line, and amount box.

- Don't cover the numbers: Be careful NOT to write over the banking numbers at the bottom of the check (the MICR line). These numbers are critical for the recipient to set up your electronic transfers.

- Record it: Make a note in your check register that this specific check number has been voided.

No Checkbook? No Problem.

If you bank with an online institution like Chime, Varo, or Ally, or simply don't order physical checks anymore, you can't use the manual method. My Check Pros solves this by letting you generate a perfectly formatted voided check PDF instantly, using just your banking details.

The Anatomy of a Check

Understanding the numbers on your check is essential for setting up payments correctly. Our tool formats these perfectly for you.

- 1Routing Number (9 Digits)The first set of numbers at the bottom left. This identifies your specific bank to the Federal Reserve system.

- 2Account NumberUsually the second set of numbers. This is your unique personal identifier at the bank.

- 3Check NumberThe short number (often 3-4 digits) used for your personal record keeping.

Our tool automatically places your routing and account numbers in the correct MICR format.

Over 5000 US banks to choose from!

Effortlessly create a void check from banks across the United States.